ReCommerce Ultimate Guide and 2022 Trends

why retailers are loving itReCommerce Ultimate Guide: What it is, How Big it is, What are 2022 Trends, and Why Retailers are Swearing by it.

ReCommerce, while not a new concept, is experiencing a transformation that fuels revenue growth, promotes customer loyalty, and accelerates environmental protection. The ReCommerce ultimate guide and 2022 Trends below are the key transforming your business and driving success.

What is the Definition of ReCommerce?

Wikipedia‘s definition of ReCommerce, also known as reverse commerce is: ” The selling of previously owned, new or used products, mainly electronic devices or media such as books, through physical or online distribution channels to buyers who repair, if necessary, then reuse, recycle or resell them.”

Online and retail businesses liquidating excess inventory at a discount using alternative distribution channels and Consumer-to-consumer reselling of products, or ReCommerce isn’t a new concept. Pioneers in the market like Craigslist and eBay have been around for over a decade. What is new is the proliferation of powerful digital marketplaces, and the ability to coordinate the distribution of inventory at scale.

How Big is ReCommerce Today and How is it Projected to Grow?

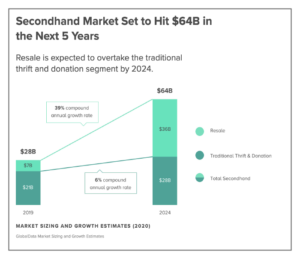

According to ThredUp’s 2020 Fashion Resale Market Analysis, C2C ReCOMMERCE, and B2B ReCommerce are expected to hit $64 billion-dollars by 2024, vs $28B a few years ago.

ReCommerce Growth 2020 to 2024

The largest eCommerce markets for the resale of secondhand goods are focused primarily on high-end and luxury items, fashion, apparel, electronics, and books. Some of the largest online stores after eBay Craigslist and Facebook marketplace are:

- Thredup ( $1B , 35,000 brands)

- Rent The Runway ( 11 Million members)

- The RealReal

- Rebagg

- Poshmark

- Depop

“ReCommerce merchants are growing 20-times faster than the broader retail market and five-times faster than off-price retailers”, according to Coresight Research. The company forecasts that “the total U.S. apparel resale market will grow at a compound annual rate of 13 percent, reaching $33 billion in 2021. Clothing, shoes, and accessories currently make up 49 percent of the total U.S. ReCOMMERCE market. GlobalData estimates that the total worldwide apparel market (resale and donation) will climb to $51 billion in 2023.”

4 Factors That Drive ReCommerce Growth in 2022

1. Millennials’ adoption of the sharing economy.

Younger consumers who are now entering prime earning potentials have proven to favor the concept of sharing over owning. Immensely successful companies such as Uber and Airbnb are only a few that comes to mind to illustrate how the sharing economy is here to stay.

2. Consumer’s desire to access used goods at a discount.

Bargain shoppers have the ability to easily shop overstock, out of seasons, or gently used products from trusted online stores without leaving their houses.

3. Powerful digital marketplaces (eBay, Craigslist, ThredUp, Etc.)

The proliferation of reliable, easy-to-use digital marketplaces that make it easy for consumers to market and sell used goods are plentiful today. They range from offering a large variety of content ( eBay and Craigslist) to curated content targeted to nice segments ( RentTheRunway, TheRealReal)

4. The environmental consciousness of consumers and brands alike.

Being able to resale used goods instead of throwing them away creates an environment where consumers can easily find an ethical outlet for the product and receive fair compensation.

3 Main Benefits of ReCommerce for Retail Brands in 2022

Liquidating excess inventory via alternative distribution channels is trusted mechanism brands use to recover a portion of the loss in sales, expand into different segments of consumers while preventing channel conflict. The rise of ReCommerce is taking on additional complexity that has proven to greatly benefits retailers and brands alike.

1. Retain Current Customers, and Build Loyalty

By proving an easy-to-use mechanism and fair market prices for used goods, retailers allow consumers to further engage with the brand. Current consumers are encouraged to bring back used goods in exchange for store credit, which fuels loyalty and additional purchases.

2. Acquire New Customers and Fuel Growth

Brands and retailers that manage returned goods are now going further by accepting goods that need to be repaired or reconditioned. When managed carefully, this new offer created an additional profitable revenue stream as the repaired goods are resold to different customers.

3. ReCommerce can Become and Intricate part of a Sustainability Program

By extending the life of a good, that product can be resold or reused as-is, or by repairing it before reselling it, brands are helping reduce the amount of waste associated with their products.

According to a report by McKinsey & Company and Global Fashion Agenda, “every percentage point increase in the circular economy market – including renting, reselling, repairing, refurbishing – could save 13 million tons of CO2 equivalent. This model is expected to reduce the fashion industry’s emissions by 13 million tons of CO2 equivalent by 2030, which accounts for 8.5 percent of the total global emissions reduction planned.”

3 ReCommerce 2022 Trends that will further solidify positively impact retailers and brands.

Need to Optimize Reverse Logistics

Retailers are working hard to master the complexities of reverse logistics to coordinate returned goods. The recent rise of online sales driven, in part, by the global covid-19 confinement and the necessity to implement contactless fewer returns, have put an additional strain on thinly stretched retailers.

2. From Consumer Goods to Capital Assets

Retailers and manufacturers are increasingly taking advantage of third-party managed ReCommerce platforms to coordinate transportation and resale of fully depreciated goods. It could be refrigeration equipment removed during a commercial kitchen or grocery store remodel. It could be fixtures, HVAC equipment, basically anything that can be resold. While some retailers find it hard to develop alternative supply chains to cost-effectively collect and resale such assets, they rely on partners whose expertise lies in reverse logistics, last-mile delivery, and B2B liquidation to eliminate the need for storage, retain the high value of the goods resold, and access liquidities.

3. Ecological ReCommerce

Turning a ReCommerce program that was only aimed a liquidating excess inventory into B2C retail solution becomes a powerful lever to transition to a circular business model. This is called “ecological ReCommerce.” It is a business model specifically aimed at reducing the environmental footprint of the product a company makes or sells. Ecological ReCommerce focuses on collecting used items for the sole purpose of repairing or recycling and reselling the reconditioned products. Another aspect of ecological ReCommerce is the reduction in post-consumer single-use packaging that is used. Retailers and brands alike have made public commitments to reducing single-use packaging, and to eliminating plastic pollution. These brands are all working together to create a systematic and effective material collection program to divert used goods from the landfill.

All of the numbers agree that ReCommerce is changing the way business is being done in multiple markets, across multiple industries. The realities of a circular economy start to become a little more apparent when you really look at how the markets are shifting on their own because of consumer choices. At this point, retailers should actively be lowing the consumer’s lead and pushing ReCommerce initiatives to stay relevant in the retail space.

If you want to learn more about how to implement a robust ReCommerce program or are looking for ways to increase customer loyalty, reduce cost, and transition to a circular business model, fill out the form below. We will get back to you in no time.

-

Circular Economy Definition: Everything You Need to Know

-

Top 5 Benefits Of The Circular Economy

-

The 4 Most Important Circularity Metrics to Measure Your Success in 2022

-

Circular Economy: 6 Fastest Ways To Become Circular

-

How Sustainability is the Key to Solving Supply Chain Issues

-

5 Benefits of an Internal Marketplace You Must Know

-

2021 1GNITE Solutions Year In Review

-

5 Important Store Refresh Best Practices For Retailers to Achieve Success in 2022